Request More Info

Thank you for your interest in Cartica Management, LLC. If you are interested in learning more about our investment approach, please click “Contact Us.”

ESG integration and active ownership is in Cartica’s DNA. Our founders pioneered ESG and corporate governance strategies over many years at International Finance Corporation (IFC), and they brought their expertise to public equity investing in emerging markets.

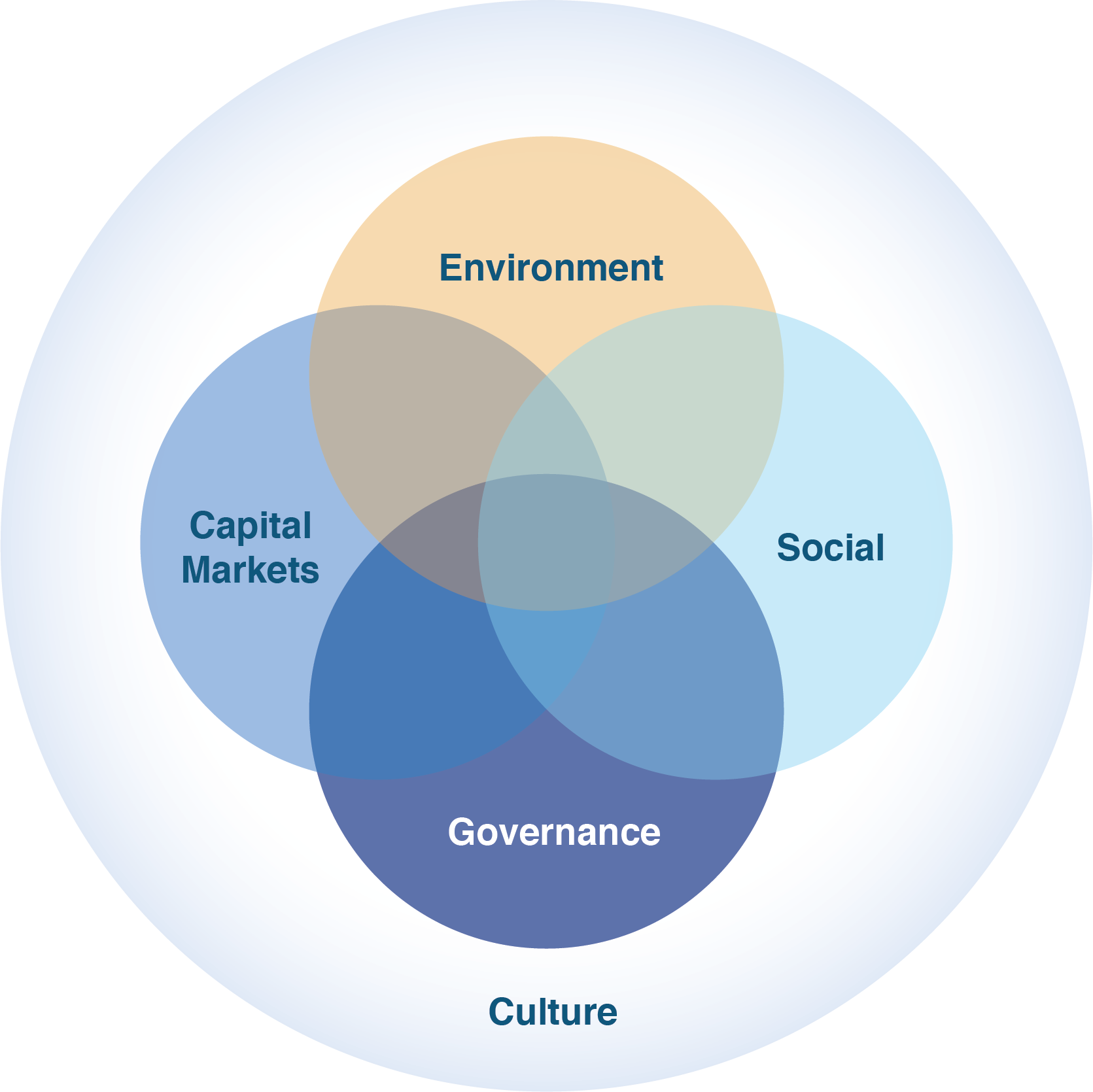

Cartica seeks to create value for portfolio companies by promoting improvements in ESG management alongside capital market-facing issues. We also focus on how a company’s corporate culture supports or weakens its ability to continually improve in areas that are material to the business. We aim to develop relationships with company leadership and ownership, and we tailor our engagement strategies to the nuances of emerging market companies and the capital markets in which they operate.

Cartica believes that companies with strong ESG practices, policies, and disclosures can outperform their peers. We focus our engagement on ESG issues, and we also advise companies on capital market-facing practices that can affect value. We look to corporate culture as a key driver of the potential for improvement on ESG and other strategies over time.

Environment

How a company manages physical & natural resources, responds to climate change, and contributes to more sustainable communities.

Capital Markets

How a company manages market-facing issues, including capital structure, liquidity, M&A, and communications.

Social

Company focus on employee engagement, health and safety, community relations, data privacy, and cybersecurity.

Culture

Norms and values that support sucessful implementation of ESG best practices and broader company strategy.

Governance

A company’s integrity and ethics, Board quality, oversight, capital allocation, and other areas affecting ownership and control.

Focus on integrity: research on management teams and majority shareholders

Understand the risks: focus on material ESG issues that can affect value and management’s ability to address them

Consider the opportunities: how a company’s practices or products that create social or environmental benefits are valued by the market

Develop an engagement strategy: how we would partner to help a company create value

Build relationships: position ourselves as partners with useful expertise for Board and management

Focus on value creation: concentrate on areas that could lead to growth and repricing by the market if improved

Educate on market demands: encourage better practices, policies, and disclosures that investors want to see

Adapt: as companies change, reevaluate material issues and engagement strategy

Cartica is a supporter of the UN Sustainable Development Goals, which have outsize importance in emerging markets. We are also a member of several organizations that keep us informed and help us to influence the field globally and in key geographies.

Thank you for your interest in Cartica Management, LLC. If you are interested in learning more about our investment approach, please click “Contact Us.”